The photovoltaic (PV)

market in the Middle East and Africa (MEA) region is set for strong growth, with

many multi-megawatt ground mount projects in the planning or pre-planning

phases. PV projects in Africa have a total potential capacity of more than

11 GW and projects in the Middle East amount to a total potential capacity

of at least 1.3 GW.

Until now, PV market

growth in the MEA region has been mainly driven by a small number of

economically prosperous countries, in particular South Africa and Israel. These

two countries, and Saudi Arabia, are expected to offer stable demand levels

within the MEA region over the next few years. The capacity share of the

remaining MEA region is projected to increase; however, the increase depends on

relatively few, but very large, projects.

More than 99% of the

potential PV capacity is from ground-mounted projects, and average sizes of

these projects in Africa tend to be larger than in most established PV markets.

Economy of scale tends to raise the attractiveness of large projects, but the

large size of ground-mount solar parks also increases risk, particularly in countries

with previously little or no existing PV markets.

In the Middle East, more

than 95% of the total PV capacity is

ground-mounted, with the strongest roof-mounted PV demand coming from Israel.

Israel is currently the largest PV market in the Middle East, with about

260 MW of completed projects, and over 300 MW of projects in the

pipeline; however, large PV projects are expected to emerge in Saudi Arabia, as

soon as the country’s renewable energy tender program begins.

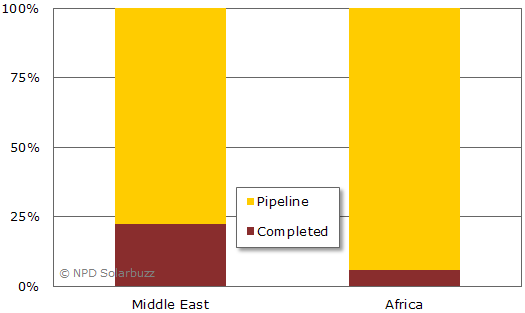

Figure

1: Completed and Pipeline PV Project Completion

Rates Across the Middle East and Africa