Year-End Rush in China Leads Asia-Pacific Solar PV Market to Set New Record

in 2014

Quarterly solar photovoltaic (PV) demand

in the Asia-Pacific (APAC) region is forecast to reach the 10 gigawatt

(GW) level for the first time in Q4’14. Annual APAC PV demand in 2014 is

forecast to grow 19% Y/Y, driven mainly by a year-end installation rush in

China, as well as strong growth in Japan.

Overall, APAC PV demand is forecast to continue growing and to

maintain shares in global PV market of more than 50% in 2015. China contributed

the most to demand in the APAC PV market in Q4’14, although China’s PV demand

was weaker than expected in the first three quarters. Ground-mount projects

still dominate the Chinese market, as the building-mount segment supported by

distributed PV subsidies slowly builds up.

Although the National Energy

Administration recently announced that only 3.79 gigawatt PV systems were

connected to the grid, many projects began construction during the first three

quarters of 2014. With a year-end surge of installations, even after three weak

quarters, full-year PV demand in China will exceed its 2013 level.

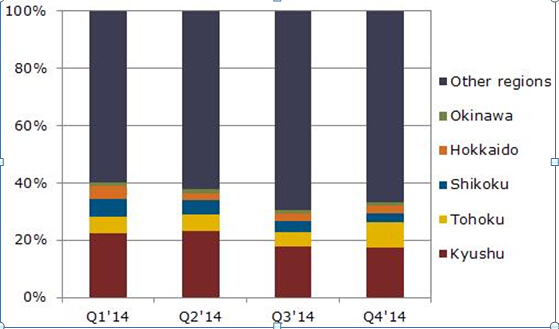

PV demand in Japan during 2014 is forecast to grow 46% Y/Y

in 2014, due to favorable government incentives. Project pipelines also

provided strong support to the Japanese PV market, reaching more than

56 GW through the end of Q3’14.

Figure:

Solar PV Demand Shares by Region in Japan in 2014

In India, the Minister of New and Renewable Energy (MNRE)

proposed increasing the Jawaharlal Nehru National Solar Mission (JNNSM) target

from 22 GW to 100 GW by 2022. Twelve states also announced their

ultra-solar park plans, with about 20 GW of projects in the pipeline. India

may become the most exciting PV market in APAC region during the next several

year . Since the new Prime Minister Narendra Modii came on board, the

government of India has announced many ambitious solar PV development plans.

In Australia, the new Renewable Energy Target (RET) is still

under negotiation, while residential installations are driving PV demand in

Q4’14 to their highest level. Meanwhile, the ground-mount segment is also

increasing, driven by construction of three large-scale, ground-mount projects.

The new China-Australia Free Trade Agreement, which potentially may resolve the

trade dispute with China on PV panels, is also good news for the Australia PV

market.

Thailand and the emerging APAC PV markets are also showing

growth potential in the coming years. The ground-mount segment is forecast to

increase its market share in emerging markets, as large projects are currently

planned in the Philippines, Pakistan, and other countries.

(Sunforson Power, Solar Mounting System, Roof Solar Mounts,

Ground Solar Mounts, Solar Carport Mounts)